The 45-Second Trick For Employer Health Care Arrangements - Internal Revenue Service

What is a good New York health insurer with plans for small startups? - Quora

How Small Business - Health Insurance Information can Save You Time, Stress, and Money.

Talk with a broker or agent to discover out about all your options on premium expenses.

Initially glance, the terms "group health strategy" and "group health insurance coverage" appear the exact same. But in truth, they suggest different things. Normally speaking, a group health strategy is a broad term for all sort of healthcare protection, whereas group medical insurance is a kind of medical insurance policy for staff members within a business or organization.

What is a group health plan? A group health strategy is an umbrella term, encompassing a variety of different type of employer-provided benefit strategies that supply healthcare to members and their families. The plan is established or kept by an organization that uses medical care to the participants directly through insurance, compensation, or otherwise.

Survey of Non-Group Health Insurance Enrollees, Wave 2 - KFF

What Does The New Jersey Small Employer Health Benefits Program Mean?

Among other things, ERISA supplies defenses for participants and recipients in staff member benefit plans, referred to as individual rights, including providing access to plan information. Likewise, those people who handle the plans and other fiduciaries should satisfy specific requirements of conduct under the duties specified under the law. This Is Cool of group health plan is group health insurance, which is a type of medical insurance coverage policy for employees or members of a company or company.

Group insurance coverage health insurance offer protection to a group of members, generally a business or organization's workers. Employees generally receive insurance at a reduced cost due to the fact that the insurance provider's danger is spread out throughout a large group of insurance policy holders. These type of insurance plans can only be acquired by groups, making people ineligible for this type of protection.

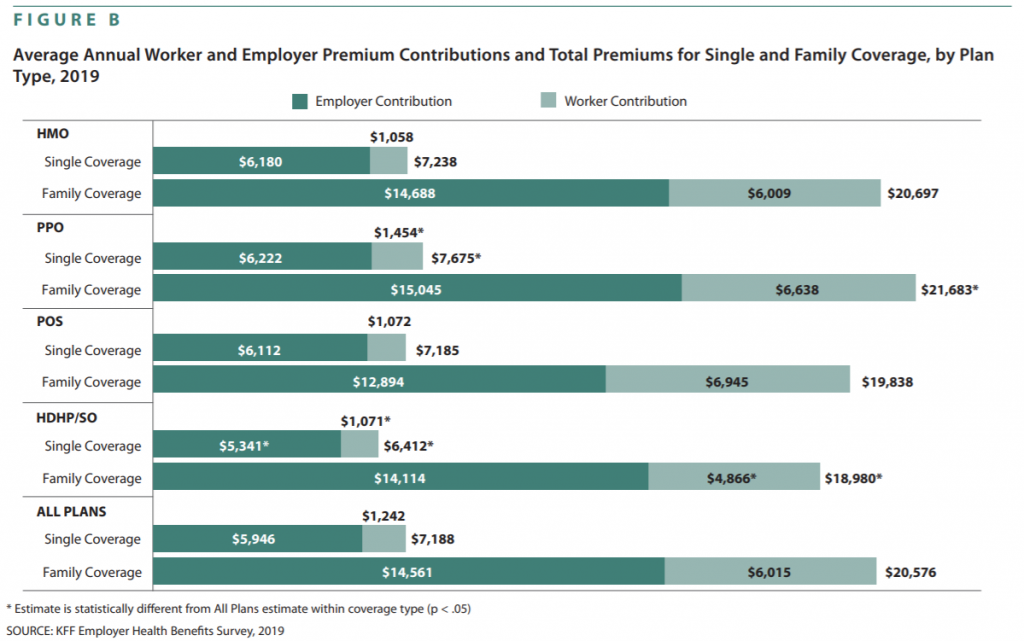

Group medical insurance strategies frequently require a 70% involvement rate Members have the option of registering in or decreasing health coverage Premiums are shared in between the business and its workers Member of the family and dependents can be contributed to group strategies at additional expense Typical group health insurance include health care organization (HMO) plans and preferred company company (PPO) strategies.

4 Simple Techniques For Employer Group Health Plan - Missouri CLAIM

PPO plans have higher flexibility and alternatives for seeing medical professionals and experts at the cost of greater premiums. What's the difference in between a group health strategy and group medical insurance? Basically, a group medical insurance strategy is a group health insurance, but a group health strategy is not always a group health insurance coverage strategy.